How Are Payroll Taxes Different From Personal Income Taxes Apex

Federal Individual Income Tax Rates and Brackets. Is a full service tax accounting and business consulting firm located in Apex NC.

Digital Financial Literacy Types Of Taxes For Google Drive 5 10a Financial Literacy Types Of Taxes Literacy

The global game board.

. 2 charged on profits from selling a house. Income taxes are used for a wide variety of government activities while payroll taxes pay for specific programs. What is the difference between an income tax and a payroll.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Payroll Tax Service. Calculation and deposit of payroll taxes for federal state and local jurisdictions.

1 charged on the value of a home. 1 charged on the value of a home. Today most states and a small number of local and municipal governments also collect income taxes.

OTHER SETS BY THIS CREATOR. Test review 2 quiz 4. We also provide Tax compliance and advisory services to business in the UK.

How are payroll taxes different from personal income taxes. Personal income tax C. 1 charged on the value of a home.

Payroll taxes paid solely by the employercompany. Payroll taxes are part of the reason your take-home pay is different from your salary. However only the payroll taxes paid by the employercompany will be reported as expenses on the companys income statement.

Personal income tax C. Start studying APEX Econ 5. Both employers and employees are responsible for payroll taxes.

How are payroll taxes different from personal income taxes. 1 charged on the value of a home. Our tax services range from Tax planning Corporation tax Personal Tax VAT HMRC Investigations Capital gains tax advice and Payroll.

Apex Economics 51 - Taxes and Tariffs. Payroll is one of the most complicated areas of accounting because of all the rules and regulations surrounding payroll. How are payroll taxes different from personal income taxes.

When you start a new job. Personal income tax C. Individual Income and Payroll Taxes.

20 charged on wages earned. B increase the purchasing power of consumers rather than decreasing it. Apex Payroll can effectively manage your entire payroll tax process.

This post will cover the basics of payroll and payroll taxes. How are payroll taxes different from personal income taxes. However each state specifies its own tax rates which we will.

Payroll taxes that are both withheld from employees gross wages and matched by the employercompany. Apex Economics 51 - Taxes and Tariffs. C reduce the demand for harmful goods rather than increasing this demand.

If your health insurance premiums and retirement savings are deducted from your paycheck automatically then those deductions combined with payroll taxes can result in paychecks well below what you would get otherwise. The tax level or percentage is higher for those with a higher income too. The Federal income tax is a progressive tax because the more a person makes in revenue the more tax they will have to pay.

Federal individual income tax was enacted in 1913 following the passage of the 16th Amendment. Learn vocabulary terms and more with flashcards games and other study tools. Is a professional accounting firm located in Apex NC assisting clients with their accounting income tax planning and income tax preparation needs in Cary Holly Springs Chapel Hill Apex Morrisville New Hill and Raleigh and other surrounding.

Payroll taxes are Social Security and Medicare contributions but these are defined as payroll taxes only on IRS Form 941 the Employers Quarterly Federal Tax Return. A tax consumption rather than wealth. Our Payroll Tax Service Includes.

A 9 B 29 C 59 D 89. Experience And Training Corporate Income Taxes Personal Income Taxes Average Tax Rate Marginal Tax Rate. Apex Econ Unit 6.

Match each type of tax with an example of its use. Our Tax Service is dedicated to helping you reduce expenses eliminate manual tasks and allocate resources for other strategic activities. Match each type of.

Employment Tax Basics The Internal Revenue Service uses the term employment taxes to refer to a list of taxes that relate to employees including IRS federal income taxes withheld from employee pay. We provide digital and cloud-based Book-keeping in UK Management Accounting and Annual Accounts. Not only do we need to calculate taxes but we also need to subtract things like retirement benefits health insurance contributions and other employee contributions.

Payroll Tax Definition. Payroll taxes that are entirely withheld from employees gross wages. TERMS IN THIS SET 40 On average about ________ per cent of an individuals consumption expenditure is for services.

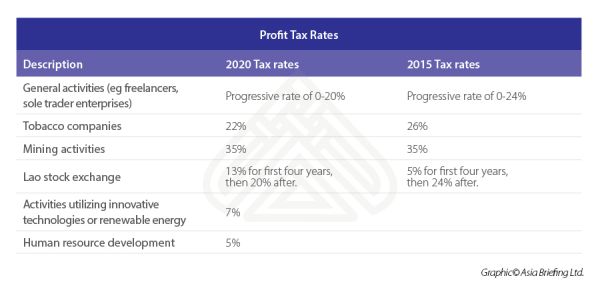

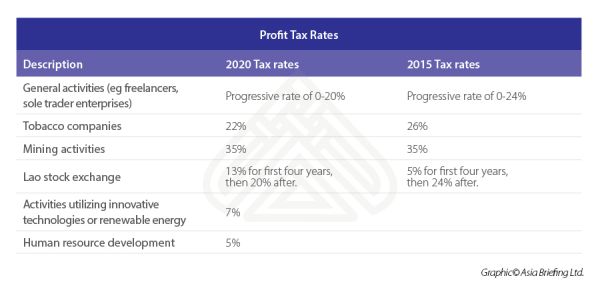

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Budgeting

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

Comments

Post a Comment